Can you recall a time when everyone in the room was looking at you funny?

This is how I felt recently at the gym, when I was walking on the treadmill. I was walking slowly. I was walking on an incline. And I happened to be walking backwards.

I had been dealing with persistent knee soreness from training for a half marathon, so I’ve been incorporating physical therapy exercises into my routine. Walking backwards is one such exercise. It looks unusual, but it has real benefits, including strengthening the muscles and increasing blood flow around the knee.1

Everyone in the room was facing in the same direction—except for me. I followed the process and stuck to the workout. I recognized that any benefits would likely take time to show up.

Investing this year has felt similar at times. It has felt as if I’m walking in the opposite direction of the crowd. The stock market has been moving—perhaps even running—towards any companies deemed to be winning in artificial intelligence and that approach has driven short-term performance. On the other hand, Right Tail has been following the same process of investing in understandable, high-quality businesses with a longer-term mindset. It’s a process I’m confident will continue to lead to long term results, not by chasing the latest theme but by a patient long term approach.

Performance Discussion

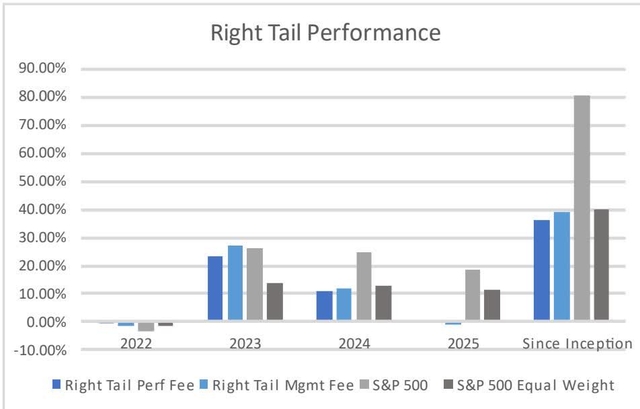

Since inception in May 2022, Right Tail’s investments have grown meaningfully. An initial $1 million investment has grown to approximately $1.36 million under our performance fee structure and to $1.39 million under our management fee structure.

To frame the long-term opportunity: if Right Tail compounds at approximately 13% annually, today’s ~$1.4 million would grow to roughly $4.75 million over the next decade and $16 million over the next 20 years. At a more modest 8% rate, it would grow to approximately $3 million in 10 years and $6.5M in 20. Long-term compounding remains our primary focus, and it’s encouraging to see progress so far.

Focusing on 2025 only, the value of our investments increased slightly. For the year, Right Tail’s portfolio is up ~0.34% before fees, compared to roughly 17.8% for the S&P 500 (SP500) and about 11.2% for the S&P 500 Equal Weight Index (SP500EW). While I’m frustrated that our returns were not higher this year, I recognize that a single year is a very short period and years like this are going to happen.

Periods like this are uncomfortable, but they are also inherent to pursuing differentiated, long-term results.

Importantly, our companies’ underlying fundamentals generally had solid years, even when share-price performance lagged.

When we look at a longer time frame, Right Tail accounts are up between 36% and 39%. While that represents meaningful wealth creation, it has lagged the S&P 500 (+79%) while performing similarly the S&P 500 Equal Weight Index (+40%). This divergence between the two benchmarks has been unusually wide and is worth discussing.

The S&P 500 is market-cap weighted, meaning that larger companies are a larger percentage of the index. As they perform well, they become even larger in the index. Today, the “Magnificent 7” represent 35-40% of the index, making the S&P 500 increasingly resemble a concentrated large-cap growth index rather than a diversified basket of 500 companies. Continued flows into passive ETFs reinforce this dynamic, as more capital automatically goes toward the largest constituents. When we look at the composition of the index over decades, leadership inevitably changes. It seems likely to me that will happen again.

By contrast, the S&P 500 Equal Weight Index assigns approximately equal weights to each company. Right Tail’s similar performance to the equal-weight index provides some perspective on how most companies in the market are faring.

Recent years—particularly 2025—have been defined by enthusiasm around artificial intelligence. Some estimates suggest the majority of the last 3 years’ returns2 were fueled by AI with 5 stocks making up ~40% of the S&P 500’s return in 20253.

I continue to study artificial intelligence and use it thoughtfully where it makes sense. Several AI-related businesses have benefited from demand far outstripping supply. That said, I do not know how long Nvidia (NVDA)’s current advantage in AI chips will last, what its normalized long-term earnings might be, or how best to value those earnings today. I’m also mindful—and somewhat uneasy—about the circularity of certain AI business arrangements, which rhyme uncomfortably with past investment bubbles. Similarly, I have not been comfortable investing in certain power-generation businesses that have performed extremely well in recent years but had filed for bankruptcy shortly before the AI boom. While these have been strong stocks, their business histories don’t align with Right Tail’s focus on sustainable, long-term, high-return-on-capital companies.

The chart below shows Right Tail performance since inception.

GRAY) S&P 500 Equal Weight (Dark Gray)’ contenteditable=”false” width=”640″ height=”409″>

GRAY) S&P 500 Equal Weight (Dark Gray)’ contenteditable=”false” width=”640″ height=”409″> Adding to Alphabet (GOOG, GOOGL) in Early 2025

I have invested in Alphabet (parent company of Google (GOOG, GOOGL)) for more than six years, and it has been a significant holding for Right Tail since inception. Throughout that period, I’ve often felt that the market has undervalued the quality and breadth of Alphabet’s business portfolio, even as the stock itself has performed reasonably well.

I first purchased Alphabet in 2018-2019 when concerns emerged that its revenue growth had dipped below 20%. Throughout the years, I continued to hold during moments of uncertainty, including the introduction of ChatGPT. Earlier this year, I added to our position when shares declined to roughly $150 amid concerns around tariffs, skepticism about Alphabet’s AI positioning, and an ongoing DOJ case. I believed the market was underappreciating Alphabet’s ability to compete in AI and the strength of businesses such as Google Cloud, YouTube, and Waymo. Alphabet stock went on to finish the year strongly north of $300 per share. Now, Alphabet is viewed as one of the leaders in the AI race and betting sites like Polymarket believe Alphabet will continue to be in the lead4. The decision to add to our investment was driven by potentially misplaced fears around AI and an open mind to both the positive and negative possibilities. I was not seeking a specific investment in AI but was ready to seize the opportunity that presented itself. This example is representative of how I aim to deploy capital – it’s an investment in a high-quality business amidst a period of heightened uncertainty.

Looking Ahead: Why I’m Optimistic About Right Tail’s Approach

I don’t know what the future holds. Artificial intelligence may continue to dominate market narratives, or a new theme may emerge. History shows that identifying long-term winners at the outset of major technological shifts is extremely difficult.

What I do believe is that, over time, markets tend to reward businesses with durable advantages, predictable earnings, and strong capital allocation—attributes that align closely with Right Tail’s investment approach. While market leadership shifts, our focus remains constant: investing in high-quality businesses at attractive prices and holding them for many years.

There are several reasons I’m optimistic about the future of the portfolio.

First, I believe there is latent value in many of our holdings. Importantly, our companies’ underlying fundamentals generally had good years, even when share-price performance lagged. For example, long-time holding Constellation Software (CSU:CA) currently trades near its lowest valuation in years, despite owning an exceptional collection of businesses with remarkable customer retention and a history of disciplined capital allocation. Concerns around AI disruption and CEO Mark Leonard’s unexpected health-related retirement have weighed on sentiment. We also own an insurance broker and an insurance underwriter where long-term fundamentals remain strong, but near-term growth has slowed. Additionally, we hold a coal royalty business that trades at less than 10x depressed cash flow, offers significant long-term optionality, and is positioned to return substantial cash to shareholders for the first time in many years.

Second, I believe the current environment is ripe for long-term active management. With such a large percentage of investing being done passively or with a short-term mindset, it makes sense why so much of the market is driven by companies with recent strong fundamentals. Right Tail provides diversification to this increasingly concentrated stock market. We have significantly less exposure to the largest companies driving market returns—exposure many of you may already have elsewhere. Somewhat paradoxically, I’m encouraged by recent relative performance patterns: Right Tail has tended to perform better during periods when large-cap technology underperforms. Interestingly, when the market was down mid teens earlier this year due to tariff related fears, Right Tail was significantly outperforming the market. I view Right Tail as a collection of high quality, better than average businesses although lately our businesses seem to be viewed as conservative stores of value. I’m OK if that’s how the portfolio performs provided our companies continue to deliver great results and maintain or grow their competitive advantages.

I also am thoughtful around taxes. Since inception I have realized tax losses each year. Despite the 40%+ unrealized net gains since inception, the Right Tail portfolio has not paid any taxes on a net basis. This is both a process that is important though should not be over-emphasized relative to selecting great investments over time. I have always thought of you as partners trying to create as much alignment as possible (I continue to be Right Tail’s largest investor) and treating you the way I’d like to be treated if our roles were reversed. Considering tax implications is one way to lead to our higher net worth for each of us over time.

What I’ve Learned This Year

This past year reinforced the importance of patience, humility, and continual learning. I remain optimistic—not because performance always moves in a straight line, but because I’m becoming a better investor over time, and our process continues to improve.

I always enjoy sharing some of the books and podcasts that I’ve found exceptional this year. David Senra’s Founders podcast has been one of my favorites for several years. Recently, he has added a new podcast called “David Senra” where he interviews some of history’s greatest living entrepreneurs.

Here are a few books and podcasts I found particularly thoughtful this year:

I remain deeply aligned with you in this work. Right Tail continues to be my largest investment by a wide margin, and I approach every decision with the same mindset I use for my own family’s capital. While results will not move in a straight line, I believe our focus on discipline, patience, and owning high-quality businesses over long periods gives us the best chance to compound value responsibly over time. I’m grateful for the trust you place in me and for the shared long-term perspective that allows us to navigate both comfortable and uncomfortable periods with clarity.

Wishing you a year of continued growth and happiness,

Jeremy Kokemor

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here